The story of fintech is a hopeful one. A generation of entrepreneurs, rising from the ashes of the 2008 financial crisis, with a different approach to finance. They created a more resilient, inclusive and stable model. This article is the story of fintech’s rise from a recession and how Covid-19 has a silver lining.

If you’re not sure what fintech is – check out “Fintech: The Hype Beast Of Business”

Opportunity from disaster

Fintech ultimately represents an innovation-driven response to financial collapse. An alternative to the monopoly of “too-big-to-fail” banks. The financial crisis brought the short-comings of financial institutions to light. Disaster fundamentally changed the way customers viewed the institutions that handled their money, their life-savings and their trust.

Financial disaster ultimately inspired entrepreneurs & investors to find an alternative to the banking system that wasn’t working. Financial technology became a movement, a technological change that prioritized inclusion, accessibility & customer-centric design over the flawed banking model before it. Additionally, the rise of smartphones, the internet of things & of the internet itself – gave creators and developers new tools to build something new from the ruins of the old.

This Youtube video is a great talk about fintech’s rise: “How Fintech is Shaping The Future of Banking“

Expectations vs Reality

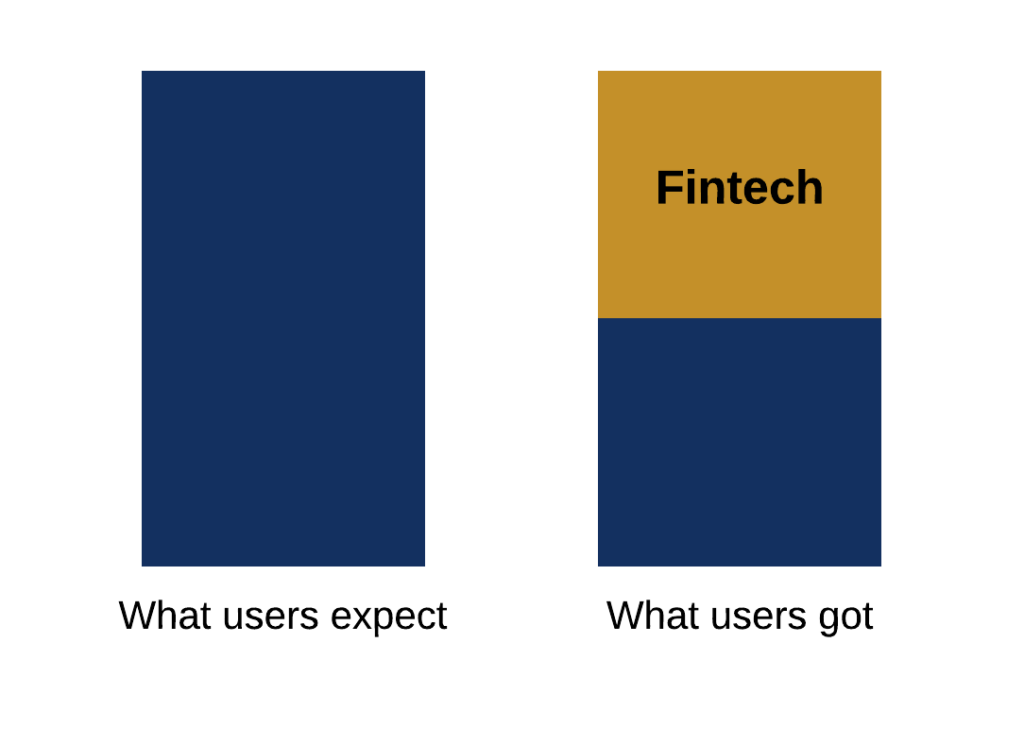

Think about what you want from your bank. Everyone wants instant service, easy access to your accounts, excellent customer service, fast payment methods, security – and impeccable customer experience. Before the financial crisis, these were things that customers started to expect, but never got.

In the beginning, fintech aimed to bridge the gap between what customers expected and what they got. In many ways, fintech assumed the customer-facing role – improving how customers paid, got financial advice and interacted with their money.

An era of collaboration

Over a decade after the collapse, fintech has grown beyond its customer-facing role. It has developed newer features – complete virtual banking, digital loans, automated virtual advice and more. For the majority of traditional banks, fintech is a growing threat – a sign of the changing times. Those who adapt & innovate will survive, the others won’t. Consequently, we find that banks are starting to collaborate in integrating and building different financial technologies.

Yes, fintech bridges the gap, but they don’t have the infrastructure nor the credibility to replace traditional banks. Similarly, banks don’t have the expertise to develop and design new technologies that fintechs have. And so what we find is that two different entities are collaborating and building off one another to build a fintech future.

Recession and fintech

No company or industry segment is insulated from the COVID recession. Fintech is no exception to that fact. With a slowing rate of innovation, a more cautious approach from investors & increasingly higher barriers of entry – many fintechs will struggle to survive. This turbulence is reflected in decreasing investments in the industry.

That said, fintech finds itself in a unique position during the pandemic. With lockdown and social distancing; contactless payments & virtual banking have proven essential to the working of banks during this pandemic. Fintech innovations are proving to be more resilient to disaster.

Indeed, the fintech industry is going to contract – and ultimately consolidate. However, those with a sound business model, business continuity plan and reliable technology will be able to weather the storm.

A maturing industry

At a fundamental level, fintech is still an extremely new industry – with many of its significant players being less than ten years old. Fintech still needs to face many challenges, one of them being regulations.

And so, we can view consolidation of the industry as a sign of it maturing. The industry’s innovations are more directed and focussed. Startups and unicorns are merging to form more powerful, reliable companies.

And yet, despite the economic downturn of Covid-19, Fintech has never found itself in a better position for growth and development. There is still massive potential for growth in AI & Big Data, Blockchain, payments, financial inclusion and more.

Conclusion

Covid-19 and its accompanying recession have shown the world how essential technologies that connect us are. Technologies that allow us to interact with our friends, work and banks. Fintech handily fills that need. Although a recession is never suitable for anyone, it provides yet another opportunity for fintechs to innovate and meet the needs of a changing society.

The fintech industry will face challenges of growth, development and in our case recession. But ultimately, fintech’s future is bright. Where the world is struggling to move past its Covid-19 challenges – fintechs are in the background innovating technologies to help us do just that.

If you’d like me to write about another interesting topic, or want notifications about my latest posts – please feel free to subscribe to my mailing list.